2024 Year in Review: Lessons for the Coming Year

2024 was a year of unexpectedly strong market performance. Major stock market indices

generated historic gains with the S&P 500 returning 25.0% with dividends, the Nasdaq 29.6%, and

the Dow Jones Industrial Average 15.0%. This occurred despite concerns around inflation,

recessions, Fed policy, and the presidential election. International stocks also performed well with

emerging markets rising 8.1% and developed market stocks gaining 4.3%.

This past year underscores the importance of staying invested during periods of uncertainty. While

trying to time the market or holding cash may often feel more comfortable, the opportunity cost of

doing so is high. There is no doubt that 2025 will present similar challenges for investors, so

working with a trusted advisor to build the right portfolio and financial plan will be even more

important.

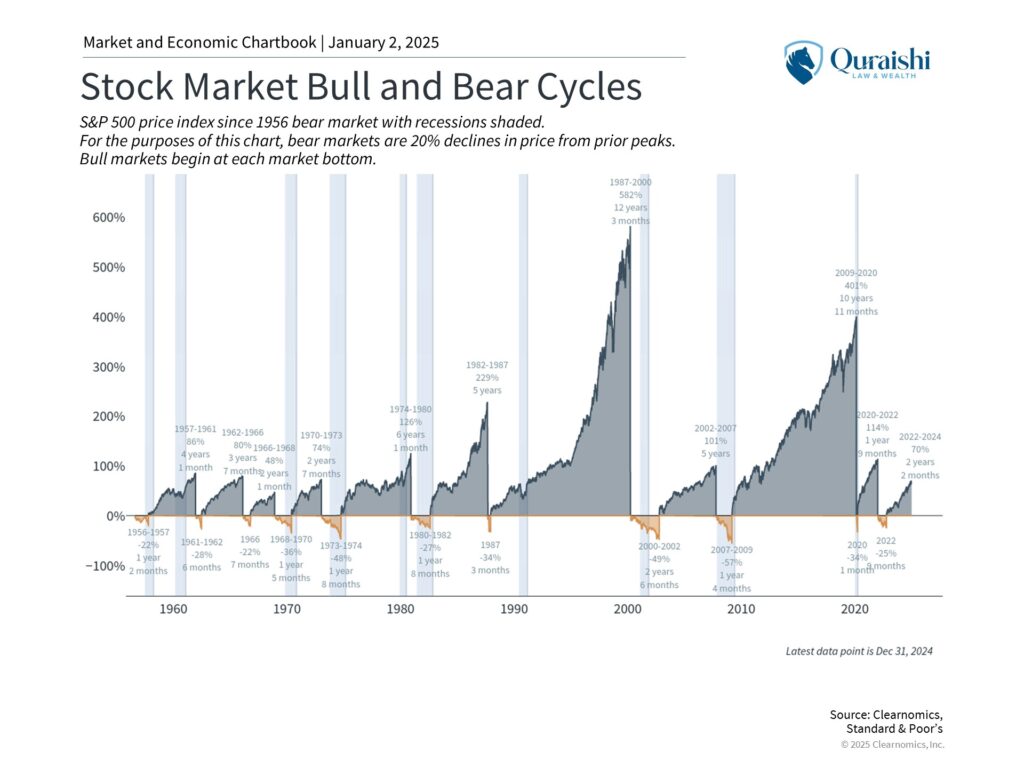

The bull market reached its two-year anniversary in 2024

The S&P 500 reached 57 new all-time highs during 2024 and ended near all-time highs, although markets did pull back slightly at the end of December. This performance adds to the remarkable gains since the market bottom in late 2022 which, in hindsight, marked the beginning of the current bull market. The market has experienced the best two years of performance since the late 1990s, with the stock market gaining 57.8% across 2023 and 2024

In fact, there were only two periods of heightened market volatility last year. This may be surprising given how nervous investors were throughout the year. These occurred in April and August when the market pulled back 5% or more due to concerns around inflation, the Fed, and tech stocks. However, each episode was followed by a sharp rebound. The accompanying chart puts bull and bear market cycles in perspective. History shows that bear markets are unpleasant, but they tend to be brief compared to bull markets. While it’s hard to say how long the current expansion will last, it’s important for investors to position for the full cycle and not just for downturns.

Of note, policy rates did decline a full percentage point due to Fed rate cuts, despite longer-term interest rates remaining elevated. The 10-year Treasury yield, for instance, ended just under 4.6%, after fluctuating between 3.9% to 4.7% throughout the year. The overall bond market was slightly positive with a gain of only 1.3% due to these rate movements

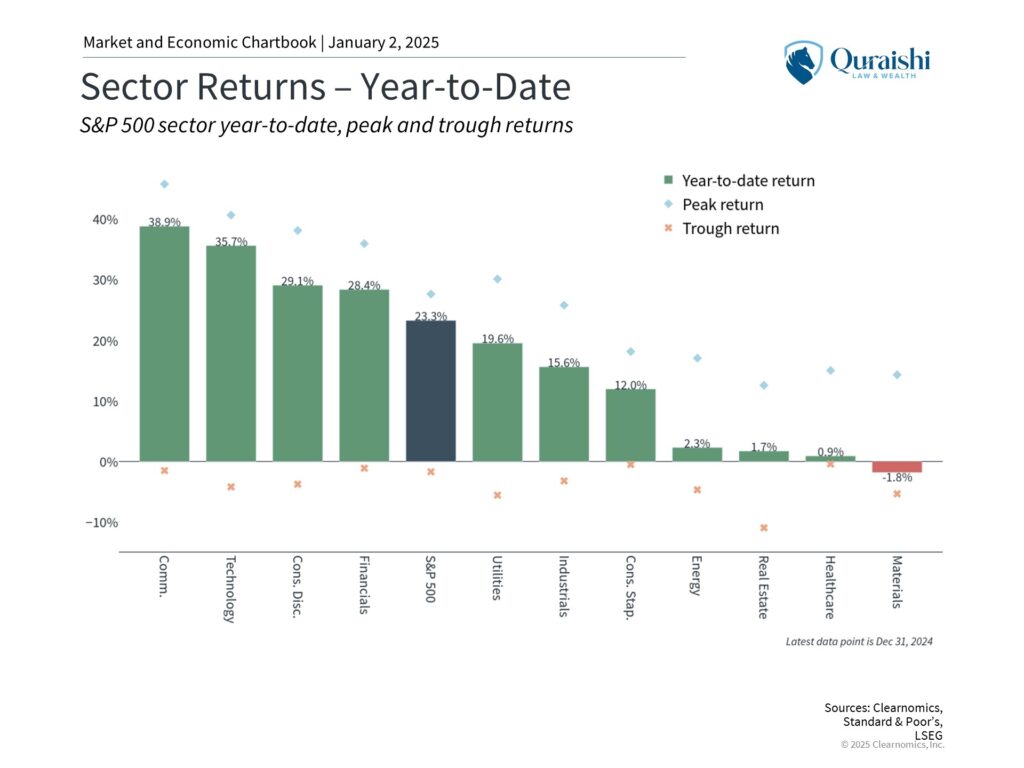

Most sectors experienced strong returns last year

Markets did not just perform well at the broad index level – many sectors benefited from the strong positive trends as well. Ten of the eleven S&P 500 sectors had positive gains in 2024, with only the Materials sector experiencing a slight loss. Markets have been driven by artificial intelligence and technology stocks over the past two years, and sectors such as Information Technology and Communication Services did outperform again. However, many other sectors experienced strong double-digit returns as well, including Consumer Discretionary, Financials, Utilities, Industrials, and Consumer Staples. In fact, the Financials sector was the best performing sector during the middle of the year. This emphasizes the importance of diversifying across various parts of the market. It’s difficult to predict which asset classes, sectors, and styles will outperform in any given calendar year. Having exposure to each of these areas in a diversified portfolio is often the best way to stay balanced

Waiting for pullbacks can be counterproductive

With markets near all-time highs, it’s natural for investors to wonder if they should “wait for a pullback.” It is certainly true that markets never move up in a straight line, and there can be

periods of volatility and short-term market declines.

The challenge is that these periods are difficult to predict and waiting for them can be counterproductive. Markets naturally achieve many new all-time highs during bull markets. And while there were two meaningful market swings this past year, major indices continued to achieve new highs throughout the year. Even when the market did pull back, it was at a higher level than where it began. In other words, it would have been better to have simply been invested the whole time.

Of course, the past is no guarantee of the future. So, perhaps most importantly, the history of markets shows that there are always concerns that prevent investors from being fully committed to their portfolios and financial plans. 2025 will likely be no different, whether the concerns are over a Fed policy mistake, the high level of stock market valuations, the growing national debt, geopolitical conflicts, or completely new and unforeseen issues.

The bottom line? 2024 is a reminder that staying invested in a well-constructed portfolio is the best way to achieve long-term financial goals. These lessons will apply equally well in 2025 regardless of the challenges the new year may bring.