SMART Financial Goals for 2025: A Guide to Success

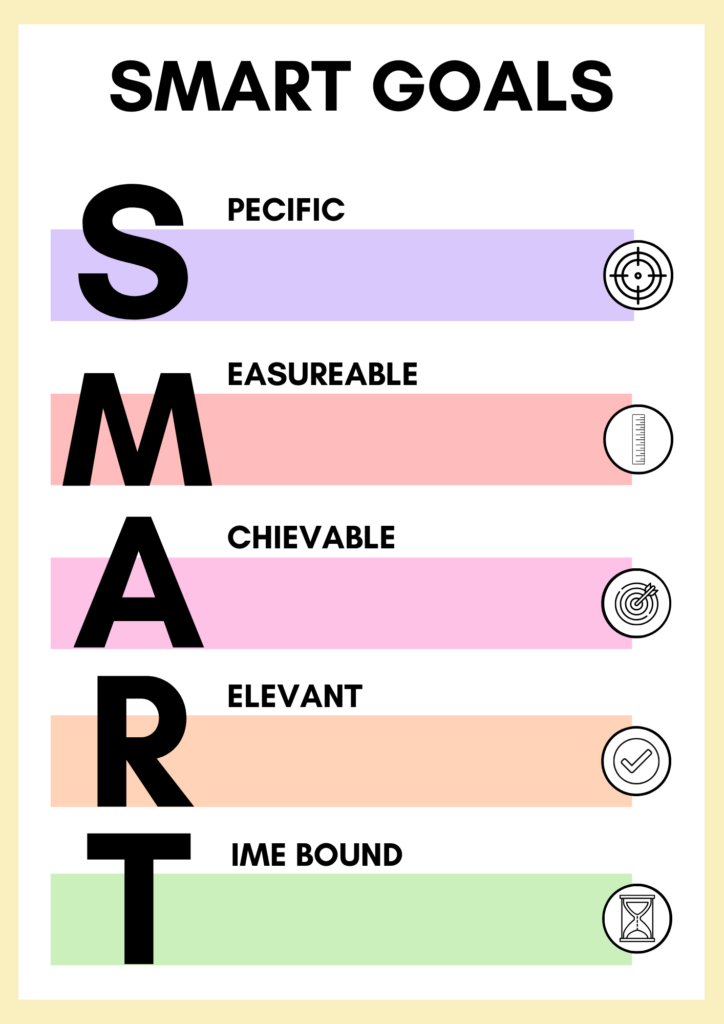

The start of a new year is a great opportunity for families and small business owners in Arkansas to take charge of their finances. Setting SMART financial goals—goals that are Specific, Measurable, Achievable, Relevant, and Time-bound—can transform your aspirations into a guide to success for 2025.

This blog post dives into how the SMART framework can provide clarity, motivation, and actionable steps for reaching your financial goals, no matter your income level.

What Makes a Goal SMART?

The SMART method ensures that financial goals aren’t just ideas floating in the air. Each element works together to make goals tangible and achievable:

Specific: Defines exactly what you want to achieve.

Measurable: Provides a way to track progress.

Achievable: Ensures the goal is realistic given current resources.

Relevant: Aligns with personal priorities and financial circumstances.

Time-bound: Sets a clear deadline to avoid procrastination.

Breaking Down the SMART Criteria

1. Specific: Clear and Detailed Goals

Why It Matters: Vague goals like “save money” lack direction and focus.

Example: Instead of “save more,” set a specific goal like “save $5,000 for an emergency fund by December 2025.”

Tip: Define the “what,” “why,” and “how” of your financialaspirations.

2. Measurable: Track Your Progress

Why It Matters: Quantifiable goals provide benchmarks to celebrate small wins.

Example: “Save $200 each month for a family vacation.”

Tool: Use budgeting apps or spreadsheets to monitor savings and expenses.

3. Achievable: Set Realistic Expectations

Why It Matters: Unrealistic goals can lead to frustration and giving up.

Example by Income Level:

(a)Higher income: Contribute the maximum to a 401(k). (b) Moderate income: Save $1,000 in an emergency fund. (c)Lower income: Start with saving $10 per week.

Tip: Factor in monthly expenses and prioritize accordingly.

4. Relevant: Align with Priorities

Why It Matters: Goals should reflect what’s important to you, whether it’s paying off debt, securing your family’s future, or growing your business.

Example: “Pay off $10,000 in business loans to free up resources for expansion.

Tip: Connect financial goals to long-term objectives, such as retirement or your child’s education.

5. Time-bound: Set a Deadline

Why It Matters: Deadlines create urgency and prevent delays.

Example: “Save $2,500 for holiday expenses by November 30, 2025.”

Tip: Break larger goals into smaller milestones with their own deadlines.

Examples of SMART Financial Goals for 2025

| Emergency Fund: | Save $6,000 by putting away $500 monthly. |

| Debt Reduction: | Pay off $4,000 in credit card debt in 12 months by allocating $333 monthly. |

| Retirement Savings: | Increase retirement contributions by $200 per month. |

| Business Growth: | Set aside $15,000 for new equipment by Q3 2025. |

Tailoring SMART Goals to Different Income Levels

No matter your financial circumstances, SMART goals can work for you:

- High-income earners: Focus on optimizing tax strategies and long-term investments.

- Moderate-income earners: Build emergency savings and prioritize high-interest debt.

- Low-income earners: Start small, such as rounding up purchases to save spare change.

The Psychological Impact of SMART Goals

Setting SMART goals doesn’t just impact your wallet—it also transforms how you think about money:

- Clarity: Breaks down overwhelming tasks into manageable steps.

- Motivation: Seeing progress keeps you inspired to stick to your goals.

- Accountability: Deadlines push you to stay on track.

Take Action: Start Your Financial Journey Today

The first step to financial success in 2025 is setting SMART goals. Whether it’s securing your family’s future, reducing debt, or growing your business, this guide to success offers a proven framework for achieving your aspirations.

Ready to take control of your financial future? Visit Quraishi Law & Wealth for expert advice tailored to your goals. Make 2025 the year where New Year, New Goals becomes a reality!